Apparently, there is only ONE App store today, and is owned by Apple. But we know that it’s not true. There are close to 120 application stores in operation as of July 2011. Some of these application stores are owned and managed by handset manufacturers such as LG and Samsung. Others are managed by owners of mobile operating systems such as Apple and Google. In particular, the bulk of the estimated 120 application stores worldwide cater for handsets using the Android mobile operating system.

Samsung Apps

Applications Impact Operators’ ARPU

The growth and presumably success of these application stores will have a positive impact on operators’ data businesses as these applications give their subscribers a reason to access the Internet on their handsets search, download and engage the apps with mobile data. Moreover, today’s applications are designed for multiple consumer segments, many of whom may not have had the inclination to download them in the first place. As such, mobile operators now incorporate mobile data as fixed bundle, vis-a-vis a VAS option, in most of today’s price plans, thereby increasing the operator’s Average Revenue per User (ARPU).

Strategic Challenges

However, such ARPU growth represents short-term advantage and risk stagnation over the long term as the premise of this strategy is based solely on providing a mobile data carriage service for their customers to use these applications to access the Internet. Such an approach is not designed to prevent customer churn as handset users can switch operators with little to no switching costs. For instance, Apple’s iCloud service will keep a record of all applications downloaded by their users (paid and free), thereby allowing any iPhone owner to access these applications following the switch to another mobile operator. In addition, the easy availability of Wi-Fi hot spots which most advanced handsets today are able to access without incurring mobile data charges diminishes the value proposition of the mobile operator’s data connectivity as a means to reduce the churn of their increasingly application-savvy subscribers.

Apple’s iCloud Service

Who Owns the User Data?

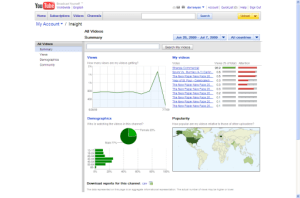

Furthermore, the growth of application stores will lead to the gradual shift of data ownership from mobile operators to operators of application stores. As these application stores are hosted on the cloud, the mobile operators have minimal, if not zero visibility on what their subscribers download, purchase history, and the incentives that promotes incremental revenue per application (e.g. in-app purchases). Such consumer insights will be owned by the owners of application stores that directly manages the end-to-end consumer value chain from app discovery to billing (for paid apps).

Confluence of Handset Design and the Internet Cloud

In addition, mobile handset manufacturers control the handset hardware specifications and user experience from the handset’s operating system. This control allows the manufacturers (working in tandem with mobile operating system developers) to influence the conceptualization process of these applications, vis-a-vis mobile operators which rarely have in-depth access to specific hardware and systems roadmaps which are proprietary information owned by the manufacturer. Therefore, the influence on application design resides primarily on the handset manufacturer, rather than the operator.

This influence brings me to the last argument that limits the future impact of operator’s data businesses. If the influence of the application design is primarily driven by the handset manufacturer, then it is not surprising to have applications that make full use of the handset’s hardware such as device GPS, accelerometer, etc. to maximize the apps’ user experience, while shifting most of the app’s processing work such as database queries at the apps’ servers hosted in other countries. This reduces the need to do multiple data transfers via the mobile Internet, reduces the need to have taxing computing requirements on the handsets and conserves battery life, a critical requirement for mobile users today.

In contrast, the price plans of mobile operators are primarily designed to have mobile data restrictions such as 200MB or 12 GB. If today’s mobile applications are not designed to increase the use of mobile data (described earlier), then any effort towards promoting variable pricing of mobile data is limited (if the mobile data restrictions are breached).

An Increasingly Fragmented Application Store Environment

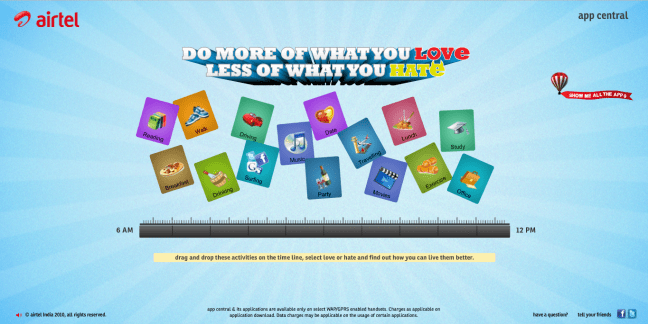

So, the future of operators’ data business will be directly affected by the application stores. Not surprisingly, most operators’ today are launching their individual app stores to mitigate the risks mentioned earlier. Bharti Airtel, MobileOne and China Mobile have launched their respective mobile application stores, and I will not be surprised if more will join these mobile operators to reduce subscriber churn and promote ARPU growth.

Airtel’s App Central